How ExFlow Solutions Empower CFOs: Enhancing Financial Control and Efficiency

Considering the vital and evolving role of the CFO in organizations, maintaining control over financial processes while simultaneously ensuring efficiency is paramount. ExFlow’s diverse portfolio of financial processing solutions for CFOs empower you to achieve this by automating complex financial tasks, reducing manual intervention, and providing real-time visibility into financial operations, enabling you to completely streamline financial processes.

With ExFlow, you can overhaul your accounts payable processes, ensuring that invoices are matched accurately and discrepancies are handled promptly. This not only improves financial control but also frees up your team to focus on more strategic activities.

Key Areas of ExFlow Solutions

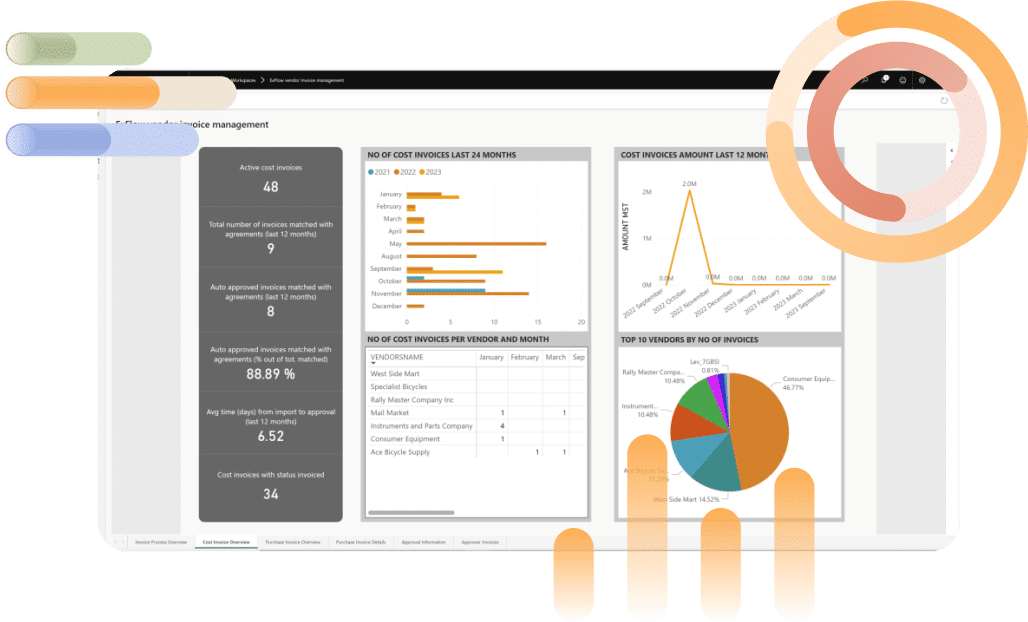

Automated Invoice Management

ExFlow AP revolutionizes invoice management by automating the matching of invoices against multiple sources such as purchase orders, contracts, and goods receipts. This automation reduces the need for manual processing, allowing your accounts payable staff to focus on managing exceptions and discrepancies. By leveraging advanced matching rules and tolerance settings within Dynamics 365, ExFlow AP ensures that invoices are processed accurately and efficiently, lowering invoice processing costs by up to 80%.

Continuous Transaction Controls (CTCs) and E-Invoicing

The evolution of financial transactions is crucial for compliance and efficiency. Continuous Transaction Controls (CTCs) and e-invoicing represent a significant advancement in financial transaction handling.

ExFlow E-Invoicing connects real-time transaction data to tax authorities, ensuring compliance and reducing the risk of tax evasion. With global connectors like Peppol, Italy’s SdI, Brazil’s NF-e, and Mexico’s CFDI, ExFlow E-Invoicing facilitates seamless compatibility with various tax authorities’ systems, ensuring that your business stays compliant with regional regulations.

The Built-in Advantage for Dynamics 365 Finance & Operations and Business Central

ExFlow solutions are built into Dynamics 365 Finance & Operations and Business Central, providing a seamless user experience without the need for additional middleware or custom development. This embedded approach ensures that your finance team works within a familiar interface, enhancing user satisfaction and reducing training time. It also maximizes your ROI on your ERP investment by leveraging the full capabilities of Dynamics 365, resulting in greater efficiency and streamlined financial operations.

Benefits of ExFlow Solutions for CFOs

Enhanced Financial Control

ExFlow provides enhanced financial control by automating critical financial processes and ensuring compliance with internal policies and external regulations. The solution’s robust matching and approval workflows ensure that all invoices are processed according to your predefined rules, reducing the risk of errors and fraud. This level of control allows you to maintain accurate financial records and make informed decisions based on reliable data.

Improved Efficiency and Accuracy

By automating repetitive and time-consuming tasks, ExFlow significantly improves the efficiency and accuracy of your financial processes. The solution’s advanced matching capabilities ensure that invoices and other documentation are processed quickly and accurately, reducing the need for manual intervention and minimizing the risk of errors. This increased efficiency allows your team to handle a higher volume of transactions with ease, ultimately saving time and resources.

Actionable Insights for Strategic Decision-Making

ExFlow’s financial processing solutions for CFOs provide valuable insights into your financial operations, enabling you to make strategic decisions based on real-time data. The system’s detailed reporting and analytics capabilities offer a comprehensive view of your accounts payable processes, helping you identify trends, monitor performance, and uncover opportunities for improvement. These actionable insights empower you to optimize your financial strategy while driving business growth.

Why Choose ExFlow for Financial Management?

Dynamics 365 offers robust financial processing solutions for CFOs, with the bonus of having ExFlow built right in to provide a comprehensive financial management platform. This combination leverages the advanced capabilities of Dynamics 365, allowing CFOs to manage budgets, forecasts, and financial reporting with ease.

How CFOs use Microsoft Dynamics in their everyday workflows highlights the benefits of a unified system that supports all aspects of financial management, from daily operations to strategic planning.

Challenges of Modern CFOs

Modern CFOs face numerous challenges, including maintaining compliance with evolving regulations, managing complex financial transactions, and ensuring the accuracy and timeliness of financial reporting.

ExFlow addresses these challenges by providing financial processing solutions for CFOs that streamline financial processes, enhance overall visibility, and ensure compliance. The software for CFOs is designed to adapt to the dynamic financial landscape, offering scalable solutions that grow with your business.

BOOK A DEMO

Ready to see how ExFlow AP can revolutionize your purchase order matching process? Schedule a demo today to experience our automated solution firsthand. Our experts will walk you through the features and benefits, showing you how ExFlow AP can streamline your accounts payable processes and improve your financial operations. Contact us to schedule your personalized demo and take the first step towards enhanced efficiency and accuracy in invoice processing.